The cost to build a condo can vary greatly depending on the size, location and amenities.

The average cost to build a new 1,500-square-foot condo in Toronto is $260 per square foot, or $405,000. The average cost to build a new 3,000-square-foot condo in Toronto is $310 per square foot, or $945,000.

In the GTA (Greater Toronto Area), developers have recently been building condos with an average selling price of $400 per square foot or more. These condos are often priced at over $1 million for a 2 bedroom unit and up to $5 million for luxury penthouse units with spectacular views over Toronto’s city skyline.

As for condos built before 1990 and located in downtown Toronto, their cost ranges from about $200 per square foot up to $300 per square foot depending on location.

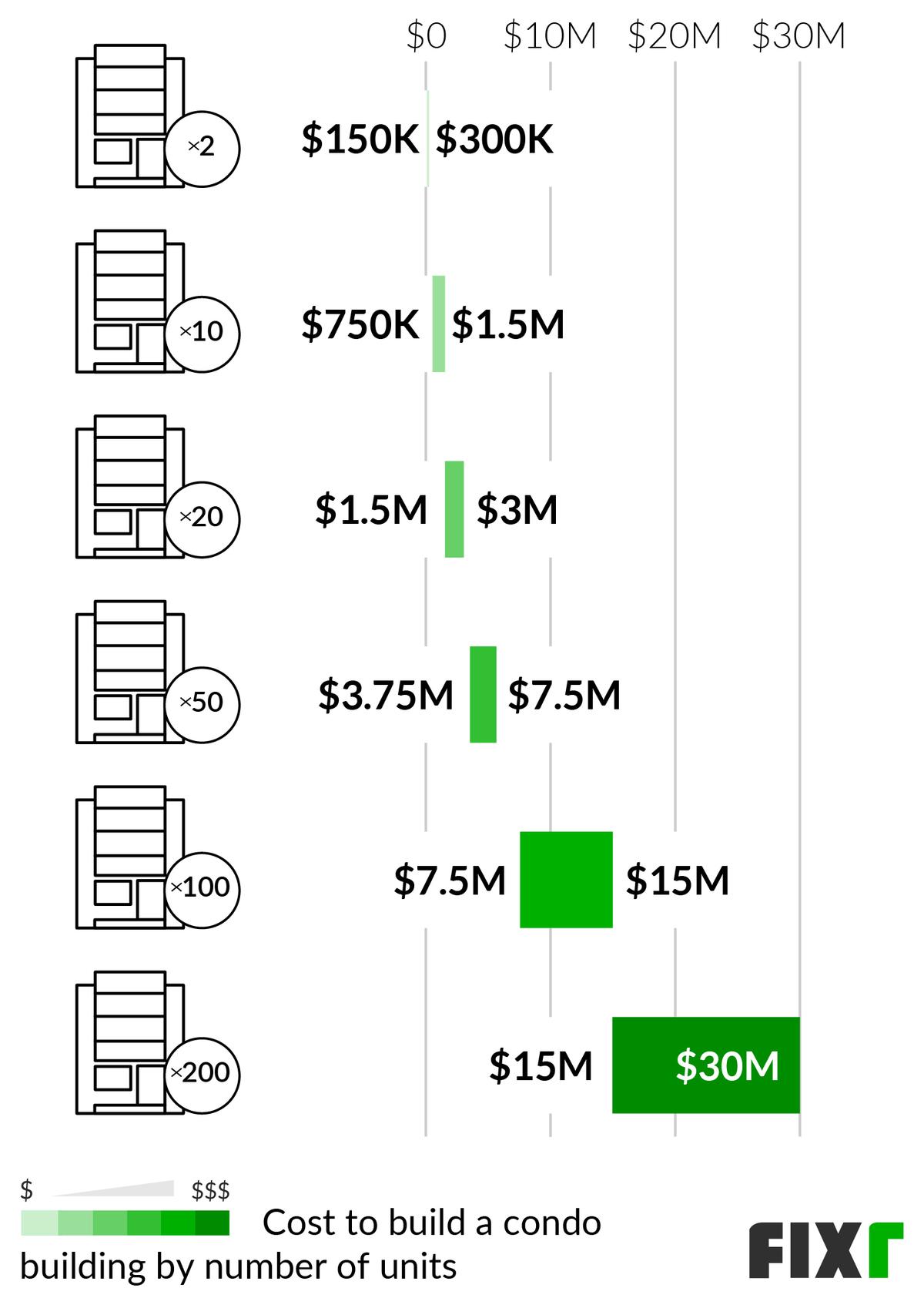

Cost to build condos

Rising real estate prices are often associated with a higher demand for housing or is often blamed on foreign investors or speculators.

While all of the above factors play a role in home price values, a big part of pricing comes directly from the developer.

Buyers are often wondering how condo developers determine the price per square foot for a condo unit. There are many factors that go into pricing pre-construction condos, such as the cost of purchasing land, construction costs, and government charges.

Before a developer begins working on a condo project, they create a pro forma to help them understand and manage their overall development costs and risks.

As land, construction costs and government charges are on the rise, real estate developers need to manage development risk with the use of pro formas.

We know that developers are not funding projects from their own pockets. There are lenders and other joint venture partners, as well as equity investors, who are contributing large sums of money to developers. These stakeholders need reassurance that their money is being managed well and that their financial contributions will generate a return on their investment.

READ: Should Toronto Condo Investors Buy Now or Wait?

Investors and end-users may not want to hear this, but developers are most certainly concerned about their bottom line.

This is why pro formas are good tools for developers in determining cost per square foot. It is not uncommon for developers to use “what if” scenarios to test project success, and one of the easiest “what ifs” is asking, “what if I raise the price per square foot?”

The price per square foot is the easiest cost to increase to meet project targets, particularly when the market environment is directly impacting developers financially, including land value and individual hard and soft costs that are required for construction and ultimately the completion of the condo project.

So, what exactly are developers taking into consideration when they set their prices? Here’s a quick breakdown for you:

Rising Land Costs

MCAP provides regular reports on municipal land values, and the data from these reports tell us that land costs truly do vary based on region. If we look at Toronto’s downtown core, for example, we can see that the average market value of high-rise condominium land is between $265 to $275 per square foot. That’s quite an expensive cost to absorb for any developer and definitely helps explain why the cost per square foot in downtown Toronto is much higher than other smaller municipalities.

Now compare this to Vaughan, a growing city with average land values of $55 to $70 per square foot. Of course, any developer building in Vaughan can now offer a more competitive price for condo projects as opposed to downtown Toronto because they aren’t required to pay hefty land costs.

This doesn’t mean that properties in Vaughan are not great investments, but it’s simply a way for buyers to understand that there is a reason why downtown Toronto condos are much more expensive on a cost per square foot basis.

It is also important to realize that demand also plays a role. So, if land values are cheaper in Vaughan, that doesn’t mean this will remain that way in the future. There may be market conditions that see a significant price increase in Vaughan’s land values if there is a flood of demand or investment in the city that is attracting a larger number of investors and stakeholders.

Hard and Soft Construction Costs

Even with vaccinations to fight the pandemic that began in 2020, the construction industry will continue to feel the long-term effects of this global health crisis. The disruption of the global supply chain, recession and lockdowns all impact construction costs in the GTA and beyond.

Buyers want a current and accurate understanding of how developers decide on a final price per square foot for pre-construction condos, which helps provide a better picture of all the varied costs that go into building a new residential condo in the GTA.

The public is often aware of things such as rising home prices, which are often associated with higher demand for housing. People often blame foreign investors for raising the cost per square foot, but pricing is more complex than that.

It is true that sometimes there is a lot of speculative investing that takes place that can increase the cost to buy a new condo. These increases are posted as the cost per square foot, which is the standard that developers use when pricing within any market condition. The cost per square foot is quite sensitive to these market conditions because developers are leveraging price growth according to existing demand.

That being said, the biggest and most direct factor for developers when setting a price per square foot is related to construction costs.

READ: Will Bill 197 Make Toronto Condos More Expensive for Investors?

In general, when builders are pre-selling condo units to qualify for construction financing, contracts and agreements are signed with buyers who are submitting deposits against predetermined prices that are to be paid in full once the project is ready for occupancy. This is why builders use their pro formas to determine all construction costs, including both hard and soft, in determining the price per square foot for each unit in the planning and development phase.

Creating accurate estimates is important to ensure developers are not underestimating costs as that can impact the viability of the entire project. If costs of development increase dramatically or poor planning went into pricing, then the builder will likely have no choice but to cancel the entire project. Experienced developers are not in the habit of cancelling projects because they know this behaviour affects their reputation.

Before a developer is able to determine a price per square foot, they need to take into consideration all of their hard costs, which are the easiest to define because they are physical in nature.

Experienced construction companies know how to estimate and determine hard costs before even starting work on the building. These professionals know the exact type and quantity of materials needed even before a developer breaks ground on a potential project.

The Altus Group produces regular reports and studies that provide insight into hard construction costs that can give buyers an appreciation for the challenging task developers face when determining the price per square foot.

According to the Altus Group’s latest 2021 Canadian Cost Guide, construction costs within the residential condominium segment can range between $250 to $340 per square foot for a 40-60 storey condo building in the GTA. Compare this value to a city such as Montreal where construction costs are only $190 to $270 per square foot.

So if buyers are wondering why cities such as Toronto cost more, then it is important to take into consideration regional differences that have higher costs. If you think about the cost involved in hiring a carpenter, excavator or even an electrician, then you will see that the hourly rate for these professionals ranges from at least $65 to $85 per hour.

On average, soft costs can vary between 15% to 20% of total buildable costs. These costs are different from hard costs because they don’t stop once a condo is completed. Soft costs continue to accrue even after everything is built and include things such as property maintenance, insurance, security, and other ongoing costs that are required to maintain an asset.

Government Charges

An often overlooked aspect of cost is related to government charges such as development charges, parkland dedication fees, and a community benefits charge (internal link to real estate info article).

Municipal governments charge developers fees that are ultimately passed back down to home buyers. What is interesting is that development charges continue to increase, even though the same municipalities are taking months and years for development approvals. For a new condominium building, the average government charges per unit are approximately $122,800, or roughly 23.9% of the average price for a new condo.

This fee is designed to ensure that developers are dedicating enough green space within their condo development plans. Builders are typically expected to dedicate at least 5% of land towards green space, but this can oftentimes be a challenge in a city like Toronto. As a result, developers are forced to pay a fee in lieu of this “Dedication” to parkland green space, which raises the builder’s overall development costs for the project.

This fee directly impacts the cost per square foot calculation because this is another added cost that developers have to pay to make sure the project is completed.

A 2018 study by the Altus Group found that GTA municipalities collected approximately $1.13 billion in parkland cash reserve fees, which is a large sum of money that is being included in the final cost per square foot for new condo projects. According to BILD, between 2006 to 2017, funds in reserve within GTA municipalities have increased from a little over $300 million to the figure we see now, which is $1.13 billion. This also shows that developers are opting more to pay cash in lieu of dedicated parkland because there is simply not enough land to build on.

BILD has found that these costs add at least $20,000 to $30,000 per unit for high-rise developments because developers are opting for cash-in-lieu contributions. So it is important to understand that this is another added cost that raises the price per square foot for investors and buyers of pre-construction condo projects.

READ: BILD Introduces New 20-Point Plan to Kick Start Ontario’s Economy

If we take, for example, the average cost per square foot of land in Toronto’s Downtown West then we can see that the average cost of land can range between $165 to $175 per square foot, which means this community benefits charge can add an additional 4% on top of that value giving it a total cost ranging between $172 to $182 per square foot. Although developers will not be charged more than 4% of land value, it is important for condo buyers to know that this is an additional cost that developers will incur and will be factored into the final calculation of the price per square foot for the purchase of a new condo unit.

Case Example: Cost Analysis for an Average GTA Condo Project

To get a more practical understanding of how developers determine the cost per square foot, let’s take a quick look at the average GTA condo project.

The average high-rise condominium land cost in the GTA is approximately $27 million for land that is 2.1 acres in size, which comes out to about $112 per buildable square foot.

As most GTA condo projects are taller than 5 storeys with more than 10 residential units, this means the developer would automatically be required to pay a community benefits charge capped at 4%.

Now let’s take a look at government fees. Average government charges in the GTA are approximately 16% of the total cost for high-rise developments. In dollars, this translates to about $96,233 per unit when purchasing a condo in Markham and $76,762 per unit when buying in Toronto.

And the third major cost is related to the construction costs developers have to pay. When we talk about construction costs, we are factoring in both soft and hard costs. As we know, hard construction costs in Toronto alone range between $200 and $260 per square foot for a 40 to 60 storey condominium building, which represents about 20% to 30% of the total cost per square foot. For a condo project that is priced at $900 per square foot, the soft cost will represent approximately $90 per square foot on average.

Therefore, when considering construction costs that include both hard and soft costs, the total comes to approximately $300 to $350 per square foot as a share of the total cost per square foot that developers charge, which is a little over a third of the cost for a condo project that is selling for $900 per square foot.

Now if we do a rough calculation of the major costs by adding land, construction costs and government charges that developers have to pay, we can see from the table below that the total cost per square foot that a developer could potentially be required to pay for the development of a high-rise condo project ranges from at least $665 to $775 per square foot for a condo project that is sold to the public at $900 per square foot. That leaves the developer with a profit margin of approximately $125 to $235 per square foot for each condo unit.

Therefore, developers are required to add up all these costs they will incur in order to get the project completed. While varying based on region, time and demand, the examples above will provide buyers a glimpse into how developers determine a final price per square foot.

Impact of Government Delays on Development Costs

There is also another factor that impacts costs per square foot and that is development approval times. On average, development approvals take between 1.5 to 2 years to obtain, which adds to the final cost because of unnecessary delays. What’s also interesting is that typically within Ontario there are no planning applications that take less than 7 months for approval, while in some cases average timelines exceeded 30 months.

A recent BILD Municipal Benchmarking Study by Altus Group found that government delays added between $58,000 and $87,000 to the cost of a 2,000 square foot low-rise home in the GTA, while high-rise condo units faced additional costs of $44,000 and $66,000 because of these delays. Therefore, when assessing cost, it is not a simple calculation because there are many variables at play that can affect the overall cost per square foot buyers are charged.

This is an important consideration because Toronto is known as having one of the slowest housing development approval times in the GTA. The City of Toronto is known for having a shortage of planners among 18 regional municipalities, which definitely contributes to higher cost for condo units.

Cost Differences Between Regions

As noted earlier, there are also regional differences that raise the cost per square foot based on factors such as climate, code, aesthetics, or even just the sheer size and nature of the development project that makes it unique or intricate. Condo projects that have luxury features and finishes will also raise costs from one city to the next. Using premium wood finishes and trim versus lower grade materials will inevitably impact cost. Sometimes you wonder why condo prices differ even within the same city and it has to do with a builder’s reputation, location, size, scope and overall finishes that are included in the project.

Key Takeaway for Investors

It is reasonable to assume and expect that developers will take a profit that is approximately 10% to 20% of the finished product. There are cases where some developers are reaching higher profit margins up to even 25% in some instances depending on the numerous factors we discussed earlier that can impact price. But, the key takeaway from all of this is that developers are not pricing condo units out of thin air – there is a calculated methodology that is outlined in a developer’s pro forma that helps guide and determine what the final price per square foot will be for new condo buyers.

Sometimes it’s easy to assume that developers are greedy or raising the cost per square foot in an effort to disadvantage home buyers, but this is often not the case. Developers are creating pro formas and using precise calculations to determine the costs involved in building a condo project from A to Z. Keep in mind that the above cost calculations are close estimates and that these numbers can vary based on location.

Investors and general buyers of condo units across the GTA need to understand that cost per square foot is a calculation that is determined in consideration of three primary aspects related to land, construction, and government charges that create the biggest percentage of costs to the final purchase price. Pricing changes from year-to-year and this trend is leading to higher costs that will ultimately raise the cost per square foot because that is the nature of our economy. Land prices rise year-over-year, as does the cost of labour, construction and obtaining the necessary materials needed to finish a project.

Furthermore, the government has a large role to play in making development costs more affordable by increasing the speed at which development approvals are made. The delay faced in cities like Toronto is not the developer’s fault and plays a big role in the affordability of real estate across the GTA.